The financial landscape of Truth Social, the social media platform founded by former President Donald Trump, has taken a significant hit as recent reports reveal a staggering loss in stock value and a direct impact on Trump's net worth. Amid the tumultuous journey of the company through the stock market, the aftermath of these developments paints a broader picture of the challenges faced by Trump's Truth Social and its pivotal role in Trump's financial and business endeavors.

The Financial Downturn of Truth Social

Image by Sergei Tokmakov, Esq. https://Terms.Law from Pixabay

Overview of the $58 Million Loss in 2023

In 2023, Trump Media & Technology Group Corp., the parent company of Truth Social, experienced a significant financial downturn, reporting a staggering loss of $58 million. This marked a sharp contrast to the company's previous financial standing, with the filings revealing a modest revenue of just $4.1 million for the entire year. The loss was a blow to the Trump Media's financial health, considering its previously reported profit of $50.5 million in 2022, a figure that was largely attributed to a change in the value of its convertible notes. Despite Trump Media's challenges, including concerns about the possibility of bankruptcy prior to a merger that infused over $275 million into the company, Truth Social's financial realities have painted a turbulent picture of its economic status.

Comparison with Previous Year's Financials

When comparing the financial performance of Donald Trump's Truth Social in 2023 to that of the previous year, the difference is stark. In 2022, the company managed to generate $1.47 million in revenue and recorded a $50.5 million profit, thanks to a favorable adjustment in the valuation of its convertible notes. However, this success was short-lived as 2023 saw the company's revenue only slightly increase to $4.1 million while incurring a substantial loss of $58 million. This downturn can be seen as a repercussion of operational and financial mismanagement, amidst other factors, impacting the company's performance negatively. The significant difference between the two years highlights the financial instability and challenges faced by Truth Social, raising concerns about its sustainability in the long term.

Implications of the Truth Social Stock Value Drop

The revelation of Truth Social's financial losses had immediate repercussions on its stock value. Upon the disclosure, Truth Social's stock value dipped by over 11%, diminishing the market valuation of the company and affecting the value of Trump's personal holdings in the company by just over $1 billion. This drop in Truth Social's stock value is concerning not only for the company but also for its investors, reflecting a loss of confidence and raising skepticism about the company's viability as a going concern. Such a financial downturn could potentially hinder the company's ability to attract new investments, further exacerbating its financial distress and casting doubt on its future prospects in an increasingly competitive social media landscape.

Trump's Net Worth Impacted

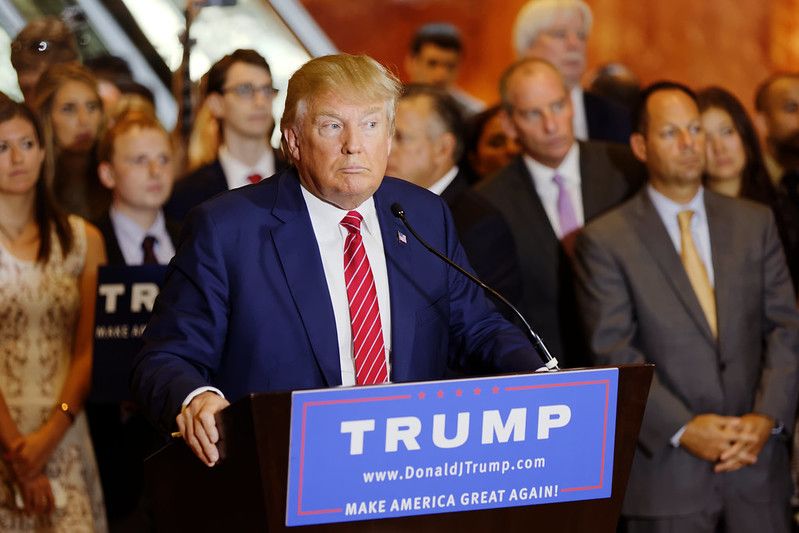

Photo by John Cameron on Unsplash

Decline in Trump's Net Worth by $1 Billion

The financial turmoil experienced by Truth Social has had a direct and profound impact on Donald Trump's personal net worth. With the company suffering a substantial loss and its stock value plummeting, Donald Trump's net worth has decreased by approximately $1 billion. This significant reduction has not only affected Trump's immediate financial standing but could also have wider implications for his ability to invest in other ventures or to use his wealth to wield influence. Such a notable decrease in Donald Trump's net worth demonstrates the financial vulnerability faced by high-profile individuals when their business enterprises encounter difficulties.

Restrictions Due to the Six-Month Lock-Up Agreement

Compounding the challenges faced by Trump in light of Truth Social's financial downturn is a six-month lock-up agreement that restricts Donald Trump's ability to sell his shares immediately. This agreement means that, despite owning a majority stake valued at roughly $4.25 billion before the stock plummeted, Trump is unable to liquidate any portion of his holdings to recover losses or to reallocate resources. This lock-up period places him in a precarious financial position, limiting his options to mitigate the impact of the company's performance on his net worth and overall financial strategy.

Legal and Financial Challenges Facing Trump

Donald Trump's financial woes are further complicated by a series of legal and financial challenges. These include facing four criminal prosecutions, the first of which concerns allegations of falsifying business records related to payments made before the 2016 election. Additionally, Trump was fined $454 million after being found to have inflated his net worth in transactions. These legal entanglements not only pose a significant threat to his financial resources but also to his reputation, exacerbating the adverse effects of the recent downturn in Truth Social's financial performance. As legal fees and potential fines accumulate, the combination of these challenges could exert additional pressure on Trump's already strained financial situation, raising questions about the future stability of his financial empire.

The Role of Meme Stocks and Market Speculation

"Donald Trump Signs The Pledge" by Michael Vadon is licensed under CC BY-SA 2.0.

Truth Social as a "Meme Stock"

Truth Social's stock behavior exhibits hallmark traits of a "meme stock." Initially propelled by both speculative trading and a significant online buzz, it saw its valuation soar despite underlying financial challenges. This phenomenon reflects a broader trend where retail investors, driven by discussions on platforms such as Reddit, engage in frenzied trading of certain stocks. These movements often result in volatile stock prices that are detached from the company's fundamental value. For Truth Social, despite reporting a substantial loss of $58 million in 2023 and generating a modest revenue, its stock witnessed substantial volatility but remained highly valued, thanks in part to its identification with the former President and the political intrigue surrounding it.

Analysts' Views on Truth Social's Valuation

Many experts argue that Donald Trump's Truth Social's multibillion-dollar valuation defies traditional financial logic. With the company reporting more than $58 million in losses in 2023 and facing continuity concerns as indicated by its accountants, skeptics are abound. Analysts compare the situation to the meme stock craze, where investment decisions are often driven by sentiment rather than substance. Despite these losses and a significant year-over-year revenue dip in the fourth quarter of 2023, Truth Social's valuation remained remarkably high, a phenomenon analysts attribute more to President Trump's controversial personality and the speculative nature of meme stocks than to the company's financial health or market performance.

Potential Strategies for Recovery

For Truth Social and other companies caught in the meme stock whirlwind, mapping a path towards financial stability and sustained growth requires innovative approaches:

- Diversification of Revenue Sources: Expanding beyond the primary service or platform to explore new revenue-generating streams can help stabilize finances.

- Community Engagement and Expansion: Leveraging the highly engaged user base by enhancing platform features and usability could foster growth in active users and, by extension, advertising revenue.

- Strategic Partnerships and Collaborations: Aligning with other media or technology entities might provide additional revenue opportunities and help improve market perception.

- Cost Management: Reducing operational expenses through strategic cost management could significantly impact the bottom line, given the current revenue challenges.

- Capitalizing on Political Cycles: Given Truth Social's unique position in the political sphere, strategically timing advertising and promotional campaigns around election cycles could drive engagement and revenue spikes.