From Humble Beginnings to Tech Titan

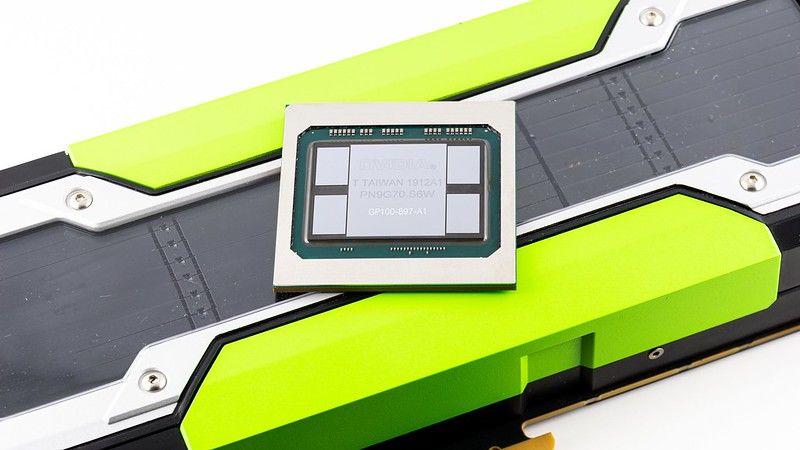

In the ever-evolving landscape of technology, a company once primarily known for its graphics processing units (GPUs) has risen to unprecedented heights. Nvidia, founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, has transformed from a niche player to a market-shaking force.

Initially focused on producing specialized GPUs for gaming and professional applications, Nvidia's innovative hardware and software solutions quickly gained a foothold in the market. By the late 1990s, the company had already secured major design wins, with its GPUs powering popular graphics cards and workstations.

As the demand for artificial intelligence (AI) and data-intensive applications surged, Nvidia's GPUs proved to be a game-changer. Their parallel processing capabilities enabled faster and more efficient training of complex neural networks, propelling Nvidia to the forefront of the AI revolution. This pivotal shift would lay the foundation for the company's meteoric rise in the years to come.

Nvidia's Stock Growth: A Five-Year Retrospective

To truly appreciate Nvidia's remarkable achievement, one must delve into the company's stock performance over the past five years. From a modest $36 per share in June 2019, the company's stock price has undergone an astronomical ascent, reaching an astonishing $1,224 per share as of June 2024 - a staggering 3266% increase.

This meteoric rise can be attributed to Nvidia's dominance in the AI and data center markets, as well as its continued innovation in gaming and professional graphics. According to market research firm IDC, Nvidia commanded an impressive 81% share of the AI chip market in 2022, cementing its position as the undisputed leader in this rapidly growing sector.

As the world's appetite for data processing and computation grew exponentially, Nvidia's cutting-edge solutions became indispensable tools for businesses, researchers, and developers alike. The company's revenue from data center sales alone grew from $2.9 billion in 2019 to a whopping $13.8 billion in 2023, a testament to the insatiable demand for its high-performance computing offerings.

Dethroning Apple: A Monumental Milestone

Photo by Pixabay: https://www.pexels.com/photo/man-holding-chess-piece-277124/

In a stunning turn of events, Nvidia has achieved a milestone that once seemed unimaginable: it has surpassed tech behemoth Apple to become the second most valuable publicly traded company in the United States, with a market capitalization exceeding a staggering $3.2 trillion as of June 2024. This feat is particularly remarkable when considering Apple's long-standing dominance in the consumer electronics and software realms, with a market cap of $2.9 trillion.

Nvidia's ascension to the upper echelons of the market capitalization hierarchy is a testament to the company's unwavering commitment to innovation and its ability to capitalize on emerging trends. According to Wedbush Securities analyst Daniel Ives, "Nvidia has become the darling of the tech world, with its chips powering everything from AI to gaming and data centers."

Implications for the Semiconductor and Chip-Making Industries

Nvidia's success has significant implications for companies operating in the semiconductor and chip-making industries. For those specializing in AI and data center technologies, Nvidia's rise to prominence could be seen as a positive sign, validating the growing demand for high-performance computing solutions. However, it also presents a formidable challenge, as Nvidia's dominance in these areas may make it difficult for competitors to gain a significant foothold.

According to a report by Gartner, the global AI chip market is projected to grow from $8.6 billion in 2022 to $33.1 billion by 2028, presenting a lucrative opportunity for companies that can keep pace with the rapidly evolving landscape.

On the other hand, for companies focused on consumer electronics or more traditional computing solutions, Nvidia's ascent could be viewed as a wake-up call. The shift towards AI, data-driven applications, and specialized hardware has disrupted the tech landscape, and those who fail to adapt may find themselves left behind.

Reactions from Industry Giants: Microsoft and Apple

Microsoft, currently the most valuable publicly traded company in the United States with a market cap of $3.4 trillion, is likely watching Nvidia's growth with a keen eye. While Microsoft has a diversified portfolio spanning software, cloud computing, and gaming, Nvidia's specialization in AI and high-performance computing could pose a threat in certain areas. However, it's worth noting that the two companies have also formed strategic partnerships in the past, such as the collaboration on the Azure AI platform, suggesting that collaboration may be a viable path forward.

Photo by Gratisography: https://www.pexels.com/photo/black-and-white-people-bar-men-4417/

Apple, on the other hand, has now relinquished its long-held position as the second most valuable publicly traded company in the United States. While Apple's consumer products and services remain immensely popular, with the iPhone alone generating over $42 billion in revenue in the first quarter of 2023, the company's focus on general-purpose computing may have contributed to its temporary dethroning by Nvidia's specialized offerings.

Regardless of how the leading companies perceive Nvidia's ascent, one thing is certain: the tech landscape is rapidly evolving, and those who can harness the power of AI, data processing, and specialized hardware will have a significant advantage.

The Future of Innovation and Adaptability

As the dust settles from Nvidia's remarkable achievement, the tech industry will undoubtedly be watching closely to see how the semiconductor giant leverages its newfound position. Will Nvidia continue to push the boundaries of AI and high-performance computing? Will it expand into new domains or form strategic partnerships with other industry leaders?

One thing is clear: Nvidia has cemented its place as a force to be reckoned with in the ever-evolving world of technology. The company's success serves as a reminder that innovation and adaptability are crucial in today's ever-changing technology landscape.

As the world continues to embrace the digital age, the demand for specialized hardware and software solutions will only intensify. Companies like Nvidia, with their finger on the pulse of emerging trends and a relentless drive for innovation, are poised to shape the future of technology.

Photo by Tomas Ryant: https://www.pexels.com/photo/future-sign-3192640/

In the words of Nvidia CEO Jensen Huang, We now have the ability to manufacture intelligence," Nvidia's remarkable journey is a testament to the power of vision, perseverance, and a willingness to embrace change.

Whether you're a tech enthusiast, an investor, or simply an observer of the ever-changing business landscape, Nvidia's ascent is a wake-up call for the entire industry. The tech titan's success is proof that in the rapidly evolving world of technology, the only constant is change itself - and those who fail to adapt risk being left behind.